Differentiators

Launching a product in China:

Certain rules apply for all branches of business.

“More interconnection equals more room for errors”, is one of those.

Launching a product in China is a process, which normally involves several parties with different areas of action, that need to be attentively managed and aligned.This is where the effectiveness of FEAST prevails.

[…]

Brand Building

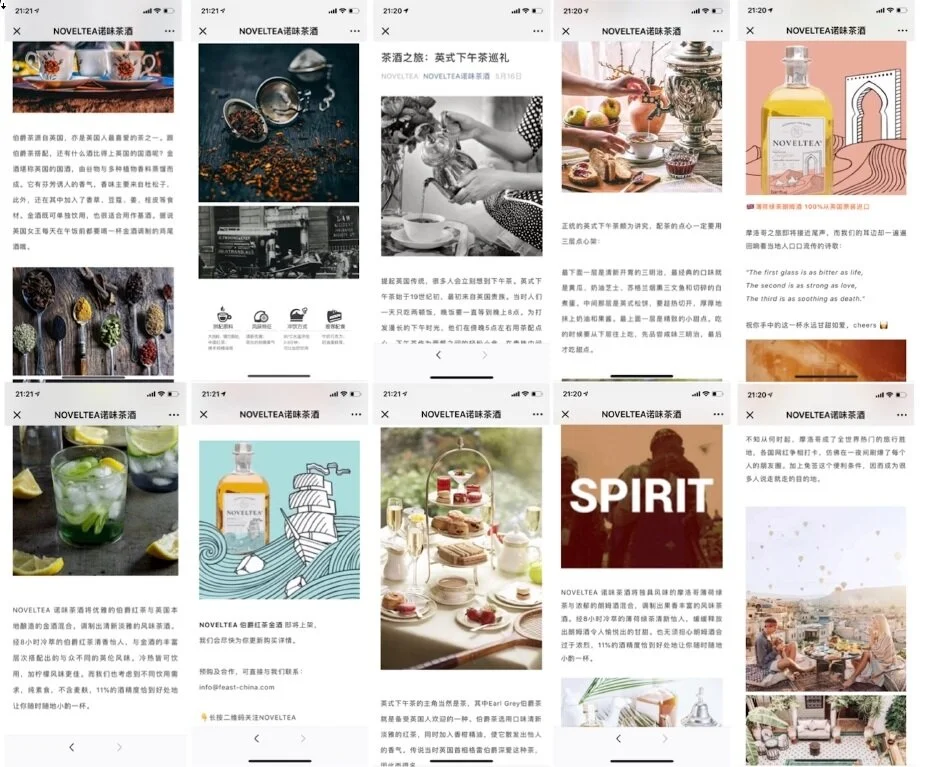

Online Owned Platforms

Brand stores & official brand accounts on major platforms including WeChat, Taobao, TMall, WeiBo, Little Red Book.

Online offsite Platforms

Launching through strong online partners who direct traffic to our products, listing in the top online stores for category.

Social Media Brand Support

Collaborations with > 120 KOLs and KOCs on China’s biggest social commerce platforms.

Professional Platform Management

A well-done WeChat presence is more important than a Chinese website

Western social media channels do not reach consumers in China. Here the digital landscape is completely different, with Tencent and Alibaba ecosystems dominating e-commerce space. That is why we focus our attention on cultivating platforms such as WeChat, China's biggest social with over 1 billion active users.

On our partner brands’ official accounts we post an average of 3 articles per month, educating our customers and followers about brand and lifestyle.

Powerful Partners

Partnerships with established category shops and distributors across Chinese e-commerce platforms (like Taobao and WeChat) enable us to collectively drive traffic toward FEAST's products. We also represent our partner brands on major Chinese eCommerce festivals throughout the year, to bring even more exposure to our brands.

Influencers and KOLs

We run campaigns with several hundreds of Key Opinion Leaders (KOLs) and Key Opinion Customers (KOCs) on e-commerce platforms such as Little Red Book, WeChat and WeiBo, TaoBao, TMall and TikTok, better known here as DouYin (China’s most trusted social shopping platform). Depending on the relevant target groups our focus on different platforms is adjusted.

Distribution Channels

Online

Owned Stores 5 major Chinese platforms (WeChat, Weibo, Taibao, TMall, Little Red Book)

Online Distributor Stores >50 stores with average monthly sales volume >200k RMB

Social Commerce >120 KOLs & KOCs promoting products through their channels

Offline

On Trade >40 stores

Retailers with focus on premium banners in top cities